What nutrients do cannabis plants need during vegetative growth stage?

What nutrients do cannabis plants need during vegetative growth stage?

what causes cannabis plants to hermie?

Cannabis plants can become hermaphroditic, develop both male and female reproductive organs, due to a variety of factors

10 Tips for Growing Dank Weed Indoors

10 Tips for Growing Dank Weed Indoors

How to spot and treat caterpillar on cannabis plants?

Caterpillars are the larval stage of moths and butterflies, and they can be a common pest on cannabis plants.

How to spot and treat aphids on cannabis plants

Aphids are small, soft-bodied insects that feed on the sap of cannabis plants, causing damage to leaves, stems, and flowers.

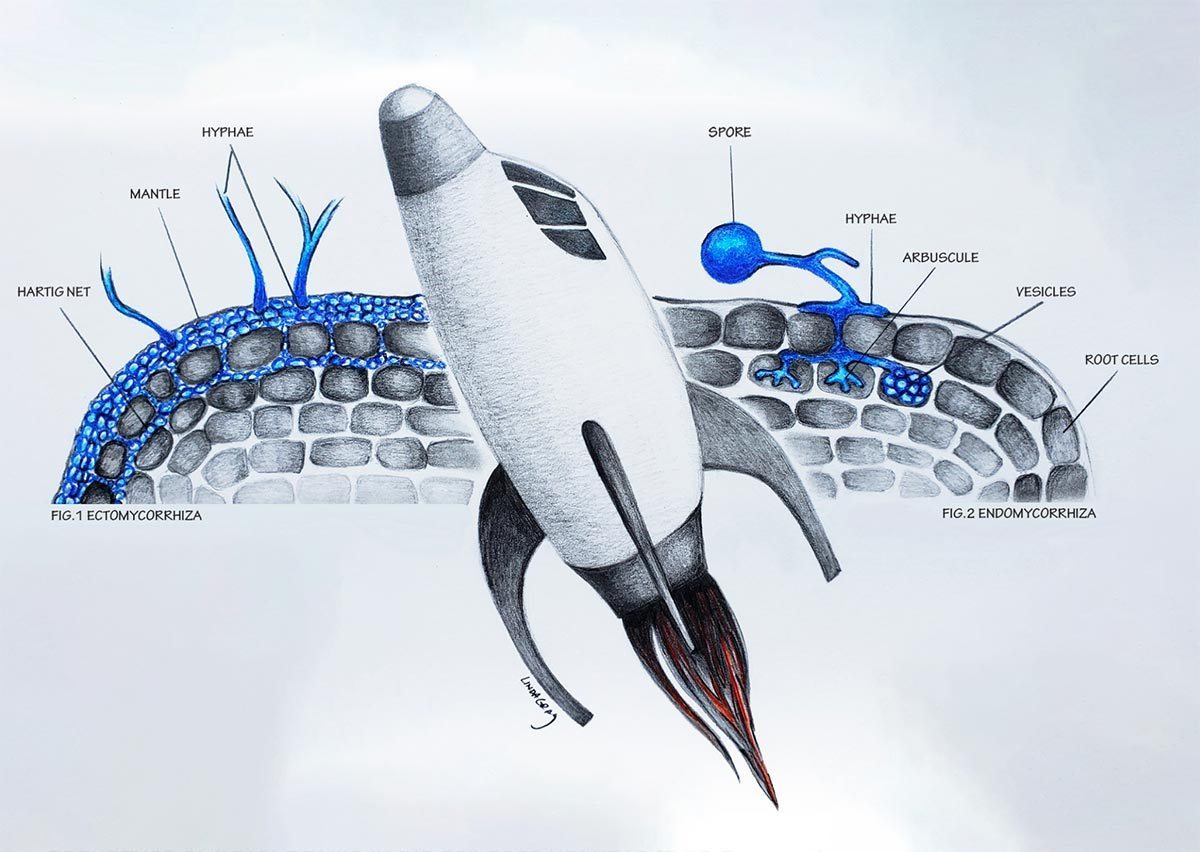

Mycorrhizae Is Not Rocket Science

Modern plant science has begun to understand that in natural habitats plant roots are a complex interaction between fungus and plant and fundamental to life ...

5 Ways to Increase Yields for cannabis plants

lighting, nutrient management, training and pruning, environmental control, and harvest timing.

How frequently should you water your cannabis plants?

The frequency of watering your cannabis plants depends on several factors such as the stage of growth, the size of the plant, the type of ...

What are the different consistencies of hash rosin?

The consistency of hash rosin can vary depending on several factors, including the type of cannabis strain, the method of extraction, and the post-processing techniques ...

The Ultimate THC-Free Cannabis Gift Guide

The best non-THC gifts to celebrate the 2020 holiday season.

What traits do breeders look for in male cannabis plants?

Breeders typically look for specific traits in male plants to ensure that the offspring will have desirable characteristics.

The Clackamascoot Reading Library

Soil Science and Plant Health